|

Korean Job Discussion Forums

"The Internet's Meeting Place for ESL/EFL Teachers from Around the World!"

|

| View previous topic :: View next topic |

| Author |

Message |

nene

Joined: 11 Jun 2005

Location: Samcheok, Gangwon-do

|

Posted: Sun Mar 29, 2009 7:21 pm Post subject: How will dollar inflation affect the Won? Posted: Sun Mar 29, 2009 7:21 pm Post subject: How will dollar inflation affect the Won? |

|

|

| For those of you who know anything about economics... inflation in the US looks more and more likely... I assume it won't have a proportional affect on the exchange rate, since the Korean economy is so tied in with the American. But if, for example, the dollar lost half its value relative to other currencies, what would you expect it to against the won? |

|

| Back to top |

|

|

Gaber

Joined: 23 Apr 2006

|

Posted: Sun Mar 29, 2009 8:59 pm Post subject: Posted: Sun Mar 29, 2009 8:59 pm Post subject: |

|

|

| I'd assume the won will come up against the US as (/if) inflation bights. Korea has pleanty more markets than just the US, they just signed a FTA with the EU, which takes 2/3rds of their exports, and the Yen is stong as an ox right now. |

|

| Back to top |

|

|

Goku

Joined: 10 Dec 2008

|

Posted: Sun Mar 29, 2009 9:13 pm Post subject: Posted: Sun Mar 29, 2009 9:13 pm Post subject: |

|

|

Ceteris paribus if we are talking strictly inflation with nothing else occuring including secondary effects (which is impossible)...

Then the Won would "rise" in value against the dollar.

But because inflation has multiple effects across affecting trading, currency exchange, monetary value, and of course price purchasing parity, it would be impossible to predict.

Not only are economists are unaware of the varibles, they are also unaware of the varibles effects.

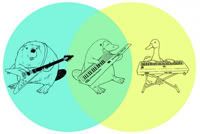

Think about it as a GIANT equation that looks like this

Exchange rate of won + Dollar is = 2X + 9Y - 3m * 29C....

And ecnomists have no idea how many varibles (X, Y, Etc.) there are and what the coefficents (ie. 2, 9, inverse relations etc,) of the varibles are. So any predictions made about how inflation effects the exchange rate should be taken with a grain of salt... |

|

| Back to top |

|

|

bogey666

Joined: 17 Mar 2008

Location: Korea, the ass free zone

|

Posted: Mon Mar 30, 2009 4:46 am Post subject: Posted: Mon Mar 30, 2009 4:46 am Post subject: |

|

|

the won is not a REAL currency.

though, granted.. there are only several of those around...

the euro, the yen, and the steling come to mind (though that has lost a lot of luster and may be in deep doo doo with the UK's Potemkin village "economy" built around "financial services". and yes.. of course the swiss franc.

the canadian loonie and the aussie dollar can also be countied in that tier, if not immediately outside of it. (possibly kiwi, but that country/economy is TINY)

if you're looking at the potentially inflationary effects of the US "printing money" process, compounded by its central banks "quantitative easings"...

you need to look at REAL currencies with central banks which still have room to cut interest rates.

Australia best fits that bill. As does the Euro.

the won though having some interest rate room/differential isn't a real currency and is frankly completely dependent on the health of the US economy which constitutes the bulk of the country's export market.

if you're looking for developing country currencies that are best positioned because their countries' don't share the US/debt structural problems and have things going for them in their own right..

I'd say... chinese yuan and brazilian real. |

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

|

|