| View previous topic :: View next topic |

| Author |

Message |

jdog2050

Joined: 17 Dec 2006

|

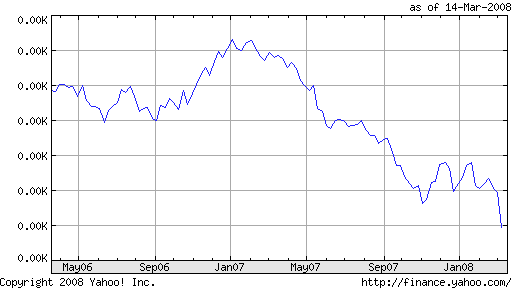

Posted: Mon Mar 17, 2008 10:53 am Post subject: Won getting rocked Posted: Mon Mar 17, 2008 10:53 am Post subject: Won getting rocked |

|

|

My currency exchange widget has it at 1024--$1.00

Buying gold in 3...2... |

|

| Back to top |

|

|

reactionary

Joined: 22 Oct 2006

Location: korreia

|

Posted: Mon Mar 17, 2008 10:55 am Post subject: Posted: Mon Mar 17, 2008 10:55 am Post subject: |

|

|

|

|

| Back to top |

|

|

fortysixyou

Joined: 08 Jun 2006

|

Posted: Mon Mar 17, 2008 4:42 pm Post subject: Posted: Mon Mar 17, 2008 4:42 pm Post subject: |

|

|

So buying gold = better than sending our won to America, right?

How does one go about buying gold?

Can I sell the gold in six months? Is that better than just saving the money here as won?

Yeah, I know very little about all of this. Appreciate your help. |

|

| Back to top |

|

|

Jessie41

Joined: 14 Dec 2007

|

Posted: Mon Mar 17, 2008 4:57 pm Post subject: Posted: Mon Mar 17, 2008 4:57 pm Post subject: |

|

|

I'm glad to finally see someone else is concerned. The exchange on my 2,200,000 won monthly salary lost almost 200 USD per month since Friday. I'm not an economist, but it seems that there is no end in sight to the won's decline against the USD at a time when the USD is falling against all other major currencies.

Any advice? |

|

| Back to top |

|

|

bassexpander

Joined: 13 Sep 2007

Location: Someplace you'd rather be.

|

Posted: Mon Mar 17, 2008 5:26 pm Post subject: Posted: Mon Mar 17, 2008 5:26 pm Post subject: |

|

|

| Set up a Euro account at your bank, and transfer it into that. |

|

| Back to top |

|

|

kalak

Joined: 06 Mar 2007

Location: dublin

|

Posted: Mon Mar 17, 2008 5:39 pm Post subject: Posted: Mon Mar 17, 2008 5:39 pm Post subject: |

|

|

no, won to euro is doing pretty much the same....

woe... |

|

| Back to top |

|

|

spliff

Joined: 19 Jan 2004

Location: Khon Kaen, Thailand

|

Posted: Mon Mar 17, 2008 5:41 pm Post subject: Posted: Mon Mar 17, 2008 5:41 pm Post subject: |

|

|

| Going to bank this afternoon to set up foreign currency acct. What currency should I set it up with? |

|

| Back to top |

|

|

suwon_swinger

Joined: 01 Oct 2007

|

Posted: Mon Mar 17, 2008 6:23 pm Post subject: Posted: Mon Mar 17, 2008 6:23 pm Post subject: |

|

|

| spliff wrote: |

| Going to bank this afternoon to set up foreign currency acct. What currency should I set it up with? |

I'm with ya...I'm clueless with this stuff but I do know that this makes me sad...

|

|

| Back to top |

|

|

GoldMember

Joined: 24 Oct 2006

|

Posted: Mon Mar 17, 2008 6:34 pm Post subject: Posted: Mon Mar 17, 2008 6:34 pm Post subject: |

|

|

I did a post on this topic some time ago. The post was titled, "Is your money safe in a Korean Bank".

At the time I was accused of being stupid and anti korean.

Here's the deal.

Korean Banks have borrowed a HUGE amount of money from Japan. Those loans are denominated in Yen. The Yen is going up up up. The banks here are facing MASSIVE foreign exchange losses, they are now scrambling to pay back those loans in order to stop bleeding.

To pay back those loans, they have to sell won.

The question is not only, how much my pay has dropped, but ALSO is my money safe in a Korean bank. |

|

| Back to top |

|

|

egrog1717

Joined: 12 Mar 2008

|

Posted: Mon Mar 17, 2008 6:48 pm Post subject: Posted: Mon Mar 17, 2008 6:48 pm Post subject: |

|

|

| So how long does everyone give it until FTs start hiding their salary under their beds?... Better than trading it in for less and less... |

|

| Back to top |

|

|

mrsquirrel

Joined: 13 Dec 2006

|

Posted: Mon Mar 17, 2008 6:51 pm Post subject: Posted: Mon Mar 17, 2008 6:51 pm Post subject: |

|

|

Don't think that the Euro is that great.

Remember that Germany and Ireland are propping up a lot of the other countries who are in the shit. |

|

| Back to top |

|

|

spliff

Joined: 19 Jan 2004

Location: Khon Kaen, Thailand

|

Posted: Mon Mar 17, 2008 7:17 pm Post subject: Posted: Mon Mar 17, 2008 7:17 pm Post subject: |

|

|

So....Euros or pounds? Or dollars  |

|

| Back to top |

|

|

ytuque

Joined: 29 Jan 2008

Location: I drink therefore I am!

|

Posted: Mon Mar 17, 2008 7:22 pm Post subject: Posted: Mon Mar 17, 2008 7:22 pm Post subject: |

|

|

On 3-17-08, the won closed at 997.35 to $1 USD. Here is a chart that you can pull up.

http://finance.yahoo.com/currency/convert?amt=1&from=USD&to=KRW&submit=Convert

The simplest way to invest in gold if you are so inclined is to open a brokerage account which allows you to invest in US securities traded on the New York Stock Exchange, NYSE. My online brokerage allows me to buy and sell for $9.99, so trading costs are minimal.

The two options that I recommend are to buy either "GLD" or "GDX." The first "GLD" is a trust which buys and stores physical gold, so you don't have to! The second "GDX" is a fund which holds a basket of gold mining stocks. By buying GDX, the risk posed to your investment by a mining company's management doing something idiotic is minimized. You could also buy stock in a gold company like Goldcorp symbol GG or Newmont Mining symbol NEM. Buying physical gold has a number of headaches associated such as how do you buy/sell and how safely can you store it.

Clearly, I recommend buying GLD. It's simple to understand what your investment is doing since you can track the price of gold minute by minute.

As for putting your money in Euros, I don't think this is a good long term strategy since the European Central Bank will at some point have to devalue the Euro to stay competitive with other currencies such as the dollar. European manufacturers are getting killed right now by the Euro:Dollar exchange rate. Already, BMW has lost billions of euros in sales.

The Korean won will continue to show weakness until the US economy and dollar have stabilized. Plus there are fundamental problems with the Korean economy and banking system. The US economy won't stabilize until the housing situation stabilizes which still has to run its course. The won will likely underperform the dollar, and when this thing has run its course, will outperform the dollar on the climb up.

Why is the dollar showing as much support as a 70 year old ex-stripper? Because the US Federal Reserve is dropping interest rates to bail out the banks who loaned money irresponsibly, and the US treasury is expanding the money supply at a double digit rate whereas the economy is growing at a low single digit rate. In other words, the supply of dollars is growing faster than the economy of the US, so dollars are worth less. Also US interest rates are low, so foreign investors are better off investing elsewhere such as in Europe.

Now if you believe in conspiracies, the US government no longer releases the figure which tracks the growth in money supply which is called M3. Why would they do that???? A nasty secret is that a number of US banks are technically insolvent. Some trick accounting with regards to valuation of their mortgage backed securities and hefty injections of liquidity from the Federal Reserve keep them going.

Good luck with your investments. |

|

| Back to top |

|

|

michael5799042

Joined: 16 Jan 2008

|

Posted: Mon Mar 17, 2008 7:23 pm Post subject: Posted: Mon Mar 17, 2008 7:23 pm Post subject: |

|

|

In my opinion it is better to change the won into another currency every month. If the won drops dramatically then your job will no longer pay well and if you leave Korea you will have to change the won you have at a bad rate. However, if you change the won monthly, then at least if it drops you will already have some money in another currency.

I figure since I work in Korea I already have a large investment in the Korean economy- keeping cash in the currencey would just increase my investment in an economy that I don't fully understand. |

|

| Back to top |

|

|

Typhoon

Joined: 29 May 2007

Location: Daejeon

|

Posted: Mon Mar 17, 2008 7:29 pm Post subject: Posted: Mon Mar 17, 2008 7:29 pm Post subject: |

|

|

| I've given it some thought. If you plan on going to your home country at sometime, not right now it is a good idea to hold your Won. Right now the Won is doing horrible against every major currency. It will right itself eventually. The question is how long will it take. I may leave in a year and I am really worried about the value of the Won. However, if you are here on the long term (3-5 more years)hold on to your Won until it comes around again. It will. This country has measures in place to prevent another IMF, so that should not be a big concern. The only real concern I have is how much of the sub-prime mortgages did South Korea buy from the States. If they bought a lot of them then there could be even bigger problems. This may be why banks and investors are in a sell off of Korean Won. If they have info. the public does not and we find out that South Korea is holding a lot of sub-prime mortgages (SPM)it will explain why the currency is falling so rapidly. Assuming the country doesn't have a lot of the SPMs (which we have to right now) then things should right themselves in time. Buying any currency right now is not a great idea because the Won is so terrible. However, if you think the Won will continue to fall over a long period of time then it would be wise to get all your money out of Korea. |

|

| Back to top |

|

|

|